Retiring federal minister Bill Shorten says the government has no plan for a publicity campaign to formally promote and explain the new Digital ID framework that comes into force on December 1.

As a result, its implementation is going somewhat under the radar.

That’s not totally surprising given that the federal parliament has been embroiled in passionate exchanges on the merits of the Misinformation Bill and the Online Safety Bill banning social media use for those under 16.

Nevertheless, the Digital ID Bill will become law on December 1, having passed the parliament in May. It has major long-term consequences on how we verify our identity and provide information to third parties.

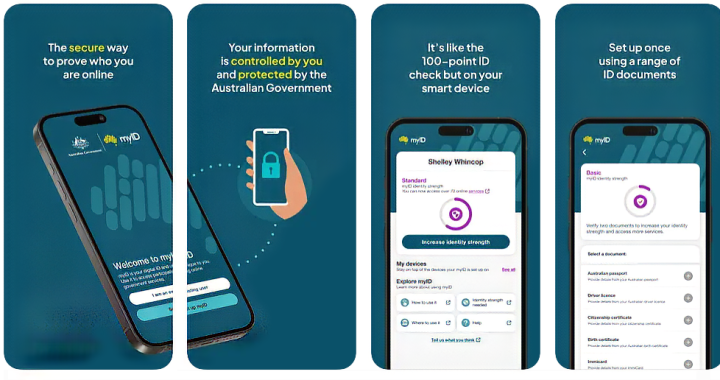

The legislation signals the eventual death knell of the old paper-based 100-points ID check system implemented in the 1980s. You’d turn up at a post office or government agency with a folder of documents to verify who you are.

The legislation lets the current embryonic Digital ID System expand beyond MyID (formerly MyGovID) and Australia Post’s Keypass system. State governments and the private sector will in future be providers of Digital ID too.

Already Australia’s major banks have joined forces to adopt the ConnectID Digital ID framework developed by Australian Payments Plus, that combines eftpos, BPAY and NPP Australia.

You’ll be soon able to verify your identity using your banking app. Waving a QR-code before a third party could verify your name, age, location and other necessary personal details. However, the third party would not keep the information.

The theory is that the days where telcos and other third parties insecurely hoard your personal information are over. Hackers won’t be able to access it because only a handful of “approved entities” such as governments and ConnectID hold it, and they hold it under lock and key.

Speaking to us on the sidelines of The National Tech Summit in Melbourne, Mr Shorten, the Government Services Minister, says there is no plan to run a high-profile awareness campaign around what is a massive change. He points to the rollout of the MyGov app as justification.

“We haven’t spent a single dollar advertising the myGov app, and there’s six million people who’ve got it,” he says, adding that the government hasn’t set any advertising budget for a Digital ID campaign.

He also points to a campaign to return $240m in unclaimed Medicare benefits to 930,000 Australians. They can check their eligibility by linking Medicare to their myGov app.

Mr Shorten does lament the slow rollout of Digital ID across Australia. A year ago, the government spruiked the second half of this year. That deadline passed.

“One, the Commonwealth moves too slowly, yeah, to be honest. That’s too slow. It frustrates me to tears,” he admits. “Two, we’ve got, still, too many silos. Every department’s a warlord.”

The soft launch approach might also suit the government with the Digital ID still being compared to the failed Australia Card proposed of1987. It was one of the biggest legislative stuff-ups of the 20th century.

The Hawke Government had the numbers to pass the Australia Card in a joint House of Representatives/Senate sitting after winning the 1987 double dissolution election, but a subsequently found flaw in the legislation meant the Coalition in the Senate could use its numbers to kill it. An embarrassed Hawke Government withdrew the Australia Card legislation.

Times have changed. In 1987 the public was worried about previously siloed government departments accumulating and sharing personal information.

In 2024, one of the big drivers for Digital ID is its ability to thwart scammers accessing and using stolen personal information to commit identity theft. Your personal data is held securely in far fewer places than now, so presumably no more hackers stealing Optus or Medibank data belonging to more than a third of our population.

Mr Shorten says the public should find it easy to use a Digital ID system that’s verified by the government and protected by multi factor authentication. “Say you’re going to book into a hotel or go to a doctor. You just put your QR code up against the QR code that the business has, and it shakes hands, and then we go on from there.”

Technically, the broader system is not there yet. “I wish I could do it yesterday, but proof of concepts is underway now, pilots early next year.”

Mr Shorten’s add-on “Trusted Exchange” or TEx system announced in August, is also in the works. It’s a distributed model that offers to protect people’s data by not holding it all in one place.

He stresses that Digital ID is an opt-in system. He isn’t worried if a “shrinking segment” of the population doesn’t use Digital ID.

“If you want to do it the slow way, the way you’ve always known, the inefficient way, (you can) knock yourself out,” he says. “Yes, we can worry about the doomsayers who might want to keep a couple of thousand dollars in cash under the bed. They should do that. I’m relaxed.”